The 10-Second Trick For Paul B Insurance Medicare Insurance Program Huntington

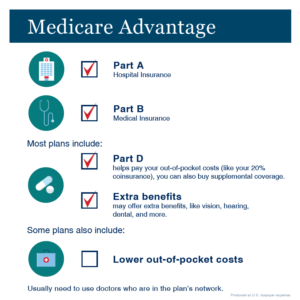

They frequently provide reduced premium costs and cover even more services than standard Medicare, while restricting like in-network companies and requiring references for assessments with specialists. Medicare Benefit can end up being pricey if you're ill, because of co-pays. The registration period is limited, and you won't be eligible for Medigap insurance coverage if you have Medicare Benefit.

All about Paul B Insurance Local Medicare Agent Huntington

Yes. Medicare Benefit offers coverage for individuals with preexisting conditions.

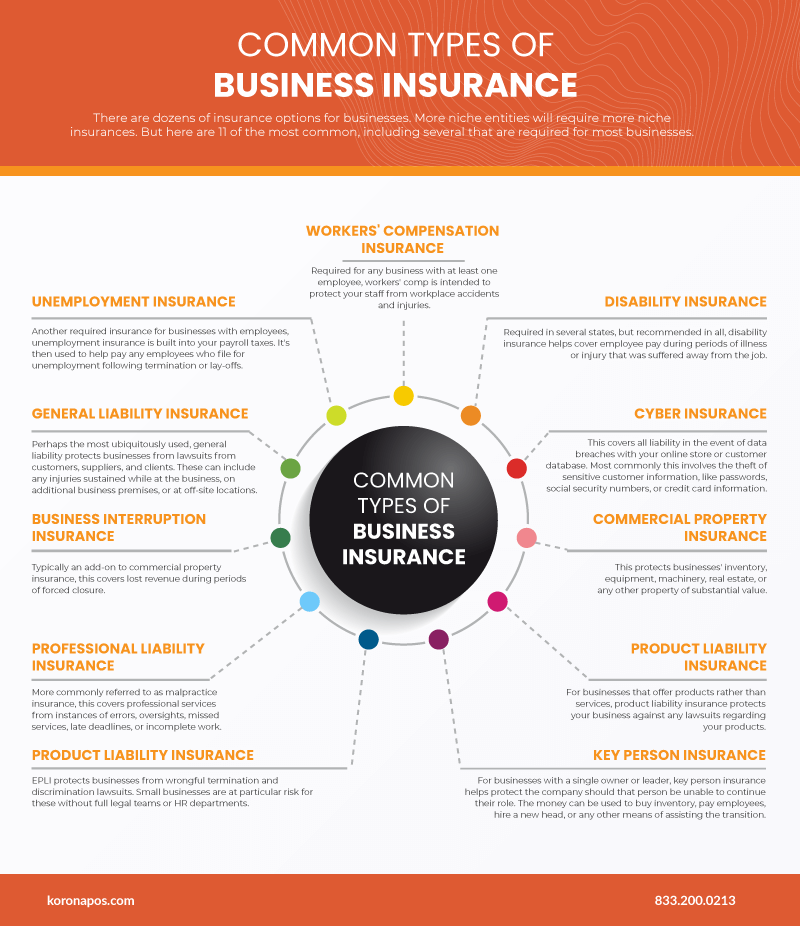

Think about a Medicare Advantage plan as detailed insurance coverage for your medical care requires. Several of the advantages most Medicare Benefit strategies have that Original Medicare does not have include: Medicare Advantage prescription drug (MAPD) plans are Part C plans combined with Component D prescription medicine strategies. While Medicare Component D provides just prescription drug insurance coverage, Medicare Benefit plans can be integrated to cover that and more.

You obtain all Medicare-covered advantages via the personal MA strategy you pick. Some MA plans deal Medicare prescription medication coverage (these are referred to as MA-PD strategies), yet various other plans do not (these are called MA-only strategies). If you join an MA-only plan, you might or may not join a separate Medicare Component D strategy depending upon the kind of MA plan you sign up with.

Some Known Details About Paul B Insurance Insurance Agent For Medicare Huntington

If hospice coverage is not used through your MA plan, you can access it independently via Initial Medicare., we have actually compiled info on the 3 kinds of Medicare Benefit plans: Some employer-sponsored and also retiree plans use wellness protection with MA strategies. See Medicare & Other Health Insurance policy to learn more.

Most most likely, neither your HMO strategy neither Medicare will certainly cover the price. Some HMOs supply Medicare Component D prescription drug coverage as well as others do not.

See Prescription Drugs for even more info. HMOs are one of the most preferred kind of MA strategy in The golden state, yet they are not offered in every component of the state. In 2023, 52 regions contend least one HMO plan. As well as 6 areas have no HMO. The counties without HMO include: Alpine, Calaveras, Colusa, Lassen, Sierra and also Trinity.

Not known Factual Statements About Paul B Insurance Medicare Agent Huntington

Medicare PPOs like Medicare HMOs have networks of service providers. If you see carriers in the network, you will certainly pay a reduced copayment than if you go to providers outside the network (these are recognized as out-of-network or non-preferred). If you see companies outside the network, the strategy still covers you yet you pay greater cost-sharing than if you see network providers.

(As a matter of fact, it's prohibited for an insurer to market you a Medigap strategy if you have a Medicare Benefit plan.)Likewise recognized as Medicare Part C, Medicare Advantage plans are offered by private insurance firms that have been authorized by Medicare. A lot of strategies supply added benefits that aren't covered under Original Medicare, which might consist of some price sharing for oral, listening to and also vision treatment.

Personal fee-for-service, or PFFS, plans: Enable you to see any kind of Medicare-approved healthcare carrier as long as they accept the strategy's settlement terms and also accept see you. You may also have accessibility to a network of service look these up providers. You can see doctors that do not accept the strategy's repayment terms, however you may pay more.

The Best Strategy To Use For Paul B Insurance Insurance Agent For Medicare Huntington

The plans you can pick from will depend on your postal code as well as county. While you could not have a great deal of Medicare Advantage alternatives if you live in a country location, city residents could have 2 dozen or even more choices readily available. Slim the area with these methods: Find the celebrity rating.

"It's based on efficiency on a variety of different points to do with quality, including points like, 'How care insurance receptive is the strategy to any issues or inquiries?'" states Anne Tumlinson, chief executive officer of healthcare research study as well as consulting company ATI Advisory. The celebrity rating goes from 1 to 5 stars, with 5 stars being superb.

The two main cost considerations are a strategy's costs and the maximum out-of-pocket price, which is the most you'll pay in a year for covered healthcare. The plan maximum can be as high as $8,300 expense in 2023, where plans with reduced out-of-pocket maximums have greater costs.

Not known Factual Statements About Paul B Insurance Medicare Advantage Agent Huntington

Prior to you shoot on a plan, most likely to the company's web site and make certain you comprehend all the benefits and limitations. "What we're seeing is that plans are supplying these new and different advantages, like at cheap car insurance home palliative treatment," Tumlinson claims. Those are amazing as well as, if you have a demand, they're something to take into consideration.

If you have any kind of concerns regarding the process, you can get to the people at Medicare at 800-MEDICARE (800-633-4227), or you can discover information at Medicare. gov. Contrast leading plans from Aetna, Phase is a licensed Medicare broker, partnered with Nerdwallet. Compare inexpensive Medicare plans from Aetna with Chapter, absolutely free, Learn more concerning the various components of Medicare and also what they cover.

:max_bytes(150000):strip_icc()/dotdash-life-vs-health-insurance-choosing-what-buy-Final-b6741f4fd8a3479b81d969f9ea2c9bb3.jpg)

/types-of-insurance-policies-you-need-1289675-Final21-42e0a09be99f439e8f155b97f6decd8e.png)